Welcome back — here’s what’s moving the markets today.

Today’s US services PMI reveals an economic paradox: growth momentum dwindles as prices accelerate to 2.75-year highs. These conflicting signals resurrect stagflation concerns just as the Federal Reserve weighs its next rate decision.

Could this price-growth divergence force policymakers into an impossible choice between battling inflation and protecting economic activity?

In today’s financial recap:

US services data sparks stagflation fears

Palantir’s AI revenue crosses $1B milestone

Abu Dhabi targets $25B AI investment fund

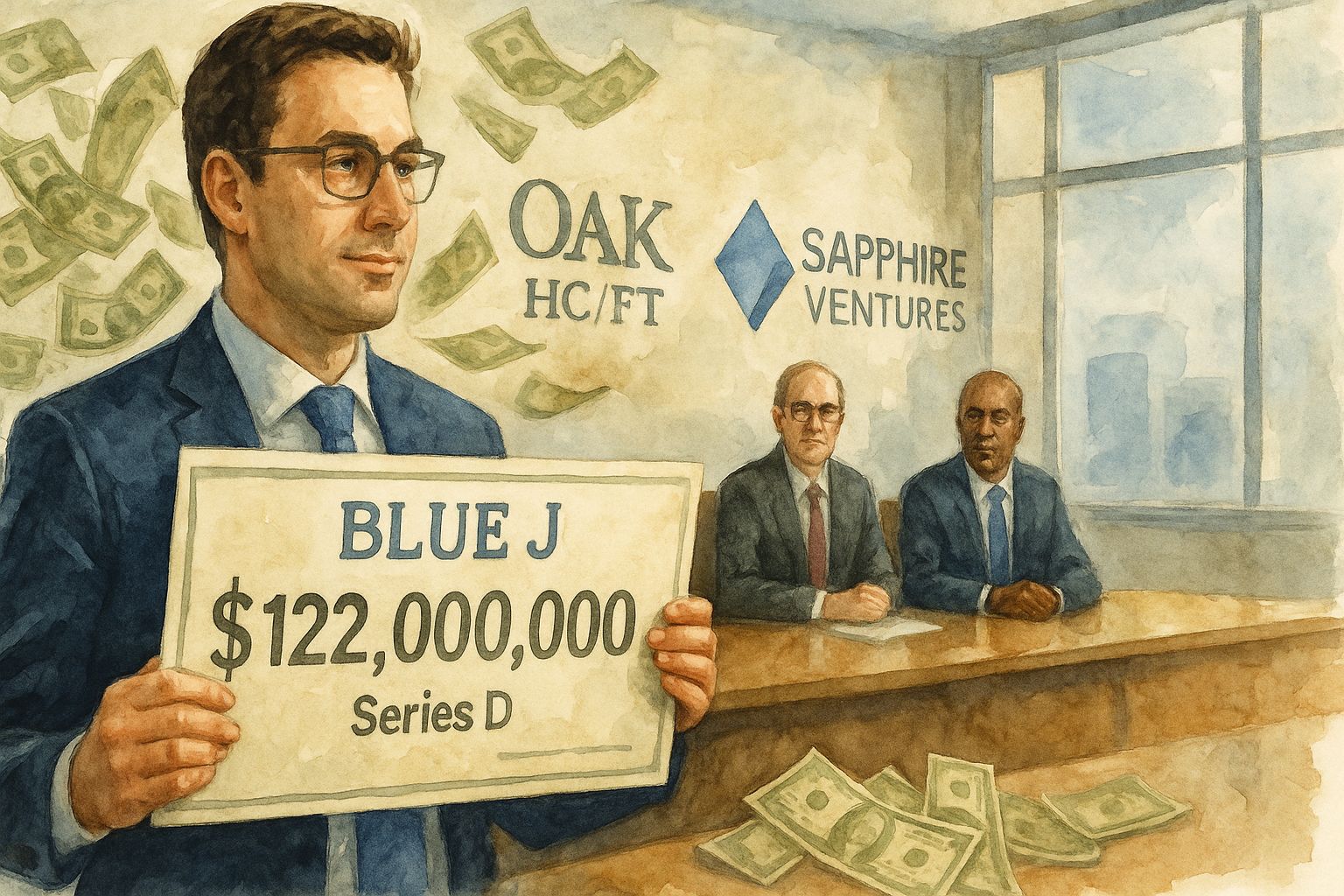

Blue J raises $122M for tax prediction AI

A Stagflation Signal?

The TradeWatch: The US services sector nearly stalled in July as the ISM Services PMI unexpectedly dropped to 50.1, while its prices paid index jumped to a 2.75-year high, flashing a warning sign for the economy.

Unpacked:

The headline PMI of 50.1 was a significant miss from the expected 51.5, showing the US economy’s largest sector has slowed to a crawl.

While growth stalled, the Prices Paid Index surged to 69.9, a 2.75-year high, signaling that inflationary pressures remain stubbornly persistent.

The underlying details were also weak, with the Employment Index falling deeper into contraction at 46.4 and the New Orders Index declining.

Bottom line: This report fuels stagflation fears and complicates the Federal Reserve’s path forward. Policymakers must now weigh a cooling economy against persistent price pressures, making the next interest rate decision much less certain.

Palantir’s AI Money Machine

The TradeWatch: Palantir reported its first-ever billion-dollar revenue quarter, shattering analyst estimates and significantly raising its full-year guidance. The blowout performance was fueled by surging demand for its AI platforms, sending the company’s stock soaring.

Unpacked:

The company’s U.S. commercial revenue skyrocketed 93% year-over-year, showcasing its rapidly growing traction within the private sector.

CEO Alex Karp credited the results to the ”astonishing impact of AI leverage” as enterprises increasingly adopt Palantir’s Foundry and AIP platforms to streamline operations.

Strong government sales, up 53%, paired with the upgraded annual forecast signals sustained, broad-based demand across its entire business.

Bottom line: Palantir’s results demonstrate its successful transition into a formidable enterprise AI powerhouse, moving well beyond its government contracting roots. This quarter’s performance suggests the corporate world is now paying a premium for practical, high-impact AI solutions.

The $25 Billion AI War Chest

The TradeWatch: Abu Dhabi’s state-backed investment firm MGX is reportedly considering raising a massive $25 billion fund to expand its investments in artificial intelligence. This move signals a significant push by sovereign wealth to capture a larger stake in the rapidly growing AI sector.

Unpacked:

The firm is chaired by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security adviser, and is backed by Mubadala Investment Co and AI firm G42.

MGX has already established a presence in the AI space with investments in high-profile companies like OpenAI and Elon Musk’s xAI.

The fund is also reportedly in talks with French AI startup Mistral to participate in a $1 billion funding round at a $10 billion valuation.

Bottom line: This potential fund highlights the growing trend of sovereign wealth directly shaping the future of foundational technology. For startups and investors, this means a new, powerful class of capital is entering the AI arena with the resources to back long-term, ambitious projects.

AI for Your Taxes

The TradeWatch: Generative AI tax platform Blue J just landed a $122 million Series D round led by Oak HC/FT and Sapphire Ventures. The raise shows big money is flowing into AI tools that solve specific, high-value problems for professionals.

Unpacked:

Blue J’s platform uses a curated database of tax law and generative AI to provide answers with source citations, letting users ask questions conversationally.

The company’s growth is accelerating quickly, with both its revenue and customer base more than doubling in the first half of 2025 alone.

Investors are betting that Blue J can become the new standard for tax research, solving a traditionally cumbersome and time-consuming task for tax professionals.

Bottom line: Blue J’s success demonstrates the massive market for vertical AI tools that target specific professional workflows. This funding positions the company to further embed its technology into the daily operations of tax experts.

The Shortlist

Tata Motors acquires IVECO’s commercial vehicle business in a €3.8 billion all-cash deal, creating a global transportation powerhouse with a combined footprint across Europe, Asia, and Latin America.

JPMorgan partners with Coinbase in a landmark deal, enabling its 80 million customers to fund accounts with credit cards and, by 2026, convert Ultimate Rewards points directly to USDC.

Boxabl lists on Nasdaq through a $3.5 billion merger with a SPAC, as the popular modular home startup seeks capital to scale production of its foldable “Casita” houses.

Cheers,

— Michael & the TradeWatch.io editorial team